Senate Passes Legislation to Establish Fixed School Tax Rate for Seniors

Hugh T. Farley

June 21, 2011

State Senator Hugh T. Farley (R, C, I - Schenectady) announced that he and his colleagues in the New York State Senate passed legislation on June 20th that would establish a fixed real property school tax rate for seniors who are eligible for the enhanced STAR exemption, providing much needed tax relief to hundreds of thousands of seniors throughout New York State.

Under the bill (S.2998), homeowners aged 70 or older and meet the eligibility requirements for the enhanced STAR exemption would be eligible to apply annually for the fixed real property school tax rate at local option. The state would reimburse school districts for lost revenue caused by freezing the tax rates for seniors.

The bill was sent to the Assembly.

Share this Article or Press Release

Newsroom

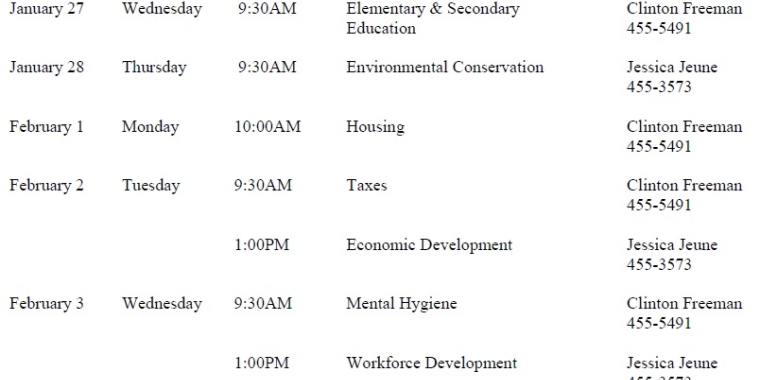

Go to NewsroomLegislature Announces Joint Budget Hearing Schedule

January 12, 2016

Senator Farley Encourages People to Donate Blood

January 8, 2016

Reporting on Recent Developments in Education Requirements

December 11, 2015

Never Forget Pearl Harbor

December 7, 2015