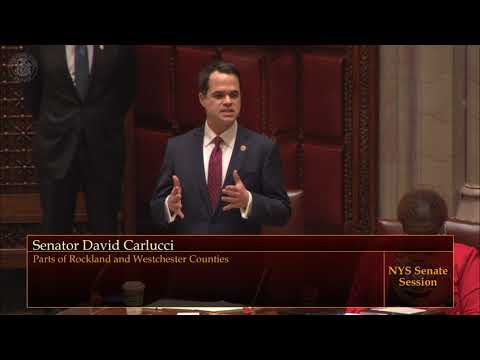

Senator David Carlucci Urges Rockland Employers to File their MTA Protective Refund Claim Before Deadline Next Friday

David Carlucci

October 27, 2012

-

ISSUE:

- Payroll Tax

NANUET, NY – As the verdict of the MTA Payroll Tax awaits a final legal decision, Senator David Carlucci (D-Rockland/Orange) today issued a stark reminder to Rockland employers that they must file their MTA Protective Refund Claims before next Friday, November 2nd to ensure that they are eligible for tax relief in the event the payroll tax is found unconstitutional.

Self-employed individuals would also have until April 30, 2013 to apply for their own refund.

“Today I am urging Rockland employers to make sure they meet this critical deadline so that they preserve their ability to file for a refund from the onerous, job-killing tax if deemed unconstitutional by the courts," said Senator Carlucci.

The case, Edward P. Mangano v. Sheldon Silver, is currently on appeal in the New York State Supreme Appellate Division. Nassau County commenced a legal action on July 29, 2010 challenging the constitutionality and legality of the MTA Payroll Tax. Recently, the Supreme Court in Nassau County ruled this to be unconstitutional, and subsequently the MTA appealed its decision.

Should the tax be found unconstitutional, employers who have previously paid the tax could be eligible for a substantial refund if they meet the required statute of limitations, or being 3 years from when they first filed payment of the payroll tax.

The payment of the MTA Payroll Tax commenced on November 2, 2009 for employers within the MTA service region.

The MTA Protective Refund Claim preserves an individual’s right to a refund should the payroll tax be determined unconstitutional after the November 2nd deadline. In other words, if the case is upheld on January 2013, this protective refund claim allows people to file for a refund even though the 3-year statute of limitations has expired.

Those who do not file a protective claim refund may still file after these dates, although these will only apply for the filing periods within the established statute of limitations.

For more information about submitting a refund claim, residents may contact Senator Carlucci's office at (845) 623-3627 or email carlucci@nysenate.gov.

To file a protective claim, there are three options that individuals can use:

- If you have an Online Service account through the NYS Department of Taxation and Finance, you may file through your services menu by visiting http://www.tax.ny.gov/online.

- Complete an electronic form by visiting https://www8.tax.ny.gov/MCPC/mcpcStart

- Call for an automated telephone application at (518) 485-2392.

Share this Article or Press Release

Newsroom

Go to NewsroomSenator Carlucci Supports Extreme Risk Protection Orders

January 27, 2019

Presser on Stronger Gun Laws

January 27, 2019

Senator Carlucci & Advocates Support Passage of Stronger Gun Laws

January 27, 2019

The José Peralta New York State DREAM Act

January 23, 2019