Senate's Budget Plan Will Enhance The Quality Of Life For All New Yorkers

March 14, 2016

ALBANY – A roadmap to a state budget that includes the lowest middle class tax rates in 70 years, another historic investment for students, a significant allocation for the state’s infrastructure, and monumental funding to combat the heroin and opioid addiction was passed today by the Senate.

Senator Catharine Young (R,C,I- 57th District), Chair of the Senate Finance Committee, and her colleagues advanced a one-house budget proposal that continues New York on the path to a sixth consecutive on-time, fiscally responsible budget.

“My focus has been on passing a budget that enacts policies that will grow jobs and boost the economy. This budget plan is a roadmap to economic prosperity for our region and all of New York State. By emphasizing policies that create jobs and boost our economy, we can build on past responsible budgeting practices to further ease the tax burden, rebuild our state’s crumbling infrastructure, support our children’s futures, and continue to ensure a brighter future for everyone,” said Senator Young.

Highlights from the Senate’s plan include a series of proposal to improve the state’s tax and business climate. Last week, the Senate put forward a plan to cut the middle class tax rates to its lowest point in 70 years and today it was passed. The plan would restructure the state’s tax code for small businesses and family farms so that they could create jobs and pass down their operations from one generation to the next. The Senate’s one-house resolution also makes the existing property tax cap permanent, bringing greater fiscal certainty for residents and businesses. Seniors will see relief under the Senate’s budget proposal through the first increase in the exempt income amount from private pensions since 1981, saving seniors approximately $275 million annually when fully phased.

Record support for the state’s education system is another hallmark of the Senate’s plan. For the state’s public education system, the Senate’s budget includes a $1.655 billion increase in aid. Included in the Senate’s budget funding is $434 million to fully eradicate the Gap Elimination Adjustment (GEA) once-and-for-all, this year. The Senate’s plan provides an $880 million increase in Foundation Aid and includes an additional $4.1 million for schools that serve the blind and deaf.

The Senate’s one-house budget proposal also includes support for New Yorkers pursuing higher education. An $87 million increase to the Tuition Assistance Program (TAP), including expanded income eligibility and increased TAP awards, is included in the Senate’s budget resolution so that more students from middle class families can receive assistance with the cost of higher education. The Senate also increases the amount of the Tuition Tax Credit and doubles the amount of qualified college expenses that can be claimed so that college students and their families can see additional savings.

The budget plan also provides $167 million in funding to strengthen prevention, treatment, recovery, and education services to combat the state’s growing heroin epidemic. The Senate’s proposal provides $10 million for transitional housing for individuals in recovery, with at least 25 percent of the funding being targeted at young people ages 15-24. An additional $6.5 million is also included for other recovery services, along with $200,000 for the training of Family Support Navigator. Navigators would help the families and loved ones of an addict, or someone in recovery, cope and provide them with the support services they need.

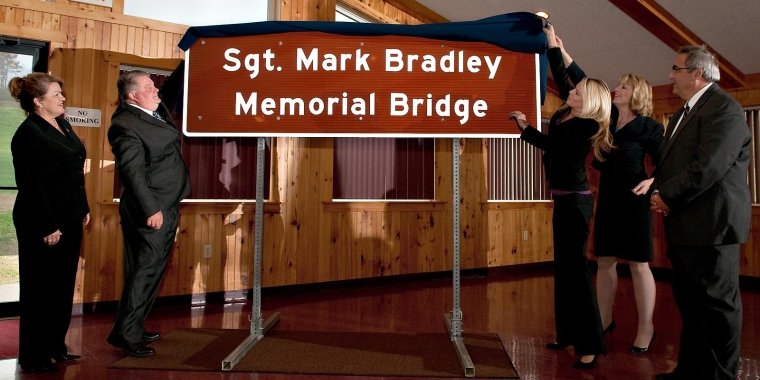

The Senate’s plan also restores parity to funding for New York’s roads and bridges. The state would invest an additional $3.5 billion in upstate roads and bridges under the plan passed by the Senate today, bringing the total five year funding to $23.6 billion, and calls for the establishment of a five year capital plan. State funding for the Consolidated Highway Improvement Program, commonly known as CHIPS, would also be increased by $40 million to a total of $478 million.

The Planting Seeds proposal, unveiled earlier this year by Senator Young and the Senate Republican Conference, makes up another cornerstone of the Senate’s budget proposal. The one-house resolution restores $32 million in funding cuts proposed by the governor for important agricultural programs. The Senate’s plan also increases funding for cooperative extensions, extends the Beginning Farmer Students Load Forgiveness Program and provides funding for high-school based FFA programs.

Veterans will also see relief under the Senate’s budget proposal, allowing peacetime veterans to obtain up to three years of additional credit toward their state retirement benefits for their military service. This plan has been previously passed by both houses of the Legislature, but was vetoed by the governor last year.

Finally, the Senate’s budget resolution again approves a Constitutional amendment to strip convicted politicians of their taxpayer funded pension and enacts into statue term limits for legislative leaders and committee chairs. With this vote, the Republican Senate Majority is once again leading by example in taking steps to help restore the public’s trust in its state government and ensuring that no one person becomes too powerful, and encourage fresh blood and new ideas.

One significant measure that the Senate rejected in their one-house budget resolution was the governor’s plan to provide $27 million in scholarships and other tuition assistance benefits, to illegal immigrants. The governor’s proposal would have resulted in free college tuition being provided to illegal immigrants using taxpayers hard-earned tax dollars.

The governor’s modifications to the STAR and Enhanced STAR programs, including capping benefits at their current rate, were also rejected by the Senate. If implemented, the program would have changed from its current upfront rebate check form into an income tax based exemption applied at the end of each year. Instead, the Senate proposed making the STAR rebate checks permanent and allocates $56 million to fully fund the tax benefit for residents and school districts across the state.