SENATE PASSES EDUCATION INVESTMENT TAX CREDIT SPONSORED BY SENATORS GOLDEN AND FELDER TO SUPPORT SCHOOLS AND HELP GIVE CHILDREN THE EDUCATION THEY DESERVE

January 12, 2016

-

ISSUE:

- Education

The New York State Senate today passed legislation that creates new tax incentives designed to encourage charitable giving to schools and improve the quality of education for students. The Education Investment Tax Credit (S1976A), sponsored by Senators Martin Golden (R-C-I, Brooklyn) and Simcha Felder (D, Brooklyn), allows those who make a charitable contribution to public schools, scholarship organizations, or other organizations providing support to public schools to receive a tax credit.

Senate Majority Leader John Flanagan said, “We need to make sure every student is given an equal opportunity to succeed in school and in life. The Senate remains committed to enacting an Education Investment Tax Credit because both private and public schools would benefit.”

Senator Golden said, “Today the Senate passed legislation that would create an education tax credit to help families. The Assembly should do the same so that hardworking tax-paying citizens are given much needed economic help to meet the rising cost of tuition. This bill will also encourage donations to schools, scholarship funds and support families of students educated through home school programs. Additionally, by permitting teachers and school staff to claim a credit for the purchase of classroom instructional materials and supplies, we are improving the value of lessons taught in our classrooms. In New York State, every student no matter where they attend classes deserves a quality education and the resources they need to succeed. This legislation will advance New York State’s interest in providing the highest quality of education to all students."

Senator Felder said, “It’s about time that tuition-paying parents start to get the relief they deserve. This bill needs to become law so at long last this goal is made a reality.”

The bill passed today is part of the Senate Republicans’ longstanding priority to make record investments in education in New York State.

The Education Investment Tax Credit provides tax incentives for qualified education donations to public schools, scholarship organizations, and local education funds.

The credit would provide a maximum tax credit of 90 percent of individuals and corporate franchise taxpayers’ qualified contributions, capped at $1 million. Eligible contributions include donations to public schools; school improvement organizations or local education funds that provide support to public schools; and qualifying educational scholarship organizations. The credit is capped at $150 million for 2017, $225 million for 2018, and $300 million for 2019 and thereafter. Taxpayers would not be allowed to use a qualified contribution as both a charitable itemized deduction and a credit against their New York State income tax.

The bill would also provide a refundable personal income tax credit for the purchase of instructional materials and supplies by teachers at public, charter, or non-public schools and by individuals who provide home-based instruction. The credit would be the lesser of $200 or 100 percent of the amount used to purchase the materials.

The bill will be sent to the Assembly.

Today the Senate also passed legislation (S6377) that eliminates the Gap Elimination Adjustment (GEA) this year and ends its devastating impact on state funding to public schools.

related legislation

Share this Article or Press Release

Newsroom

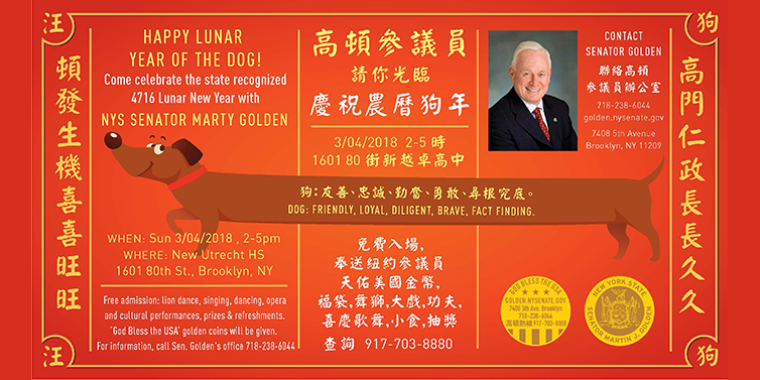

Go to NewsroomHappy Lunar Year of the Dog!

February 26, 2018

Annual Easter Egg Hunt

February 26, 2018