Carlucci Introduces New Legislation to Prevent Unemployment Insurance Hikes on Small Businesses

Senator David Carlucci

May 15, 2020

(New City, NY) – On Thursday, Senator David Carlucci (Rockland/Westchester) introduced legislation (S.8231) that will lower unemployment insurance costs for small businesses. The bill will amend the labor law to prohibit the inclusion of unemployment claims as a direct result of the COVID-19 pandemic from being factored into a businesses’ experience rating charges. An experience rating is used to assess unemployment insurance rates. Once the economy reopens, businesses could be met with extremely sharp increases on unemployment insurance due to record unemployment in NYS.

Senator David Carlucci said, “The Trump administration left minority and women owned businesses behind, while bailing out large corporate chains. We need to take every step we can in New York to help the heart and soul of our economy. This is about protecting jobs and making sure small businesses are not further crippled by unemployment insurance.”

Carlucci brought the bill up Thursday at a public hearing held by the New York State Legislature in an effort to help businesses in the most need who he said the federal government left behind. Carlucci asked if any of the panelist knew what their unemployment insurance rates could be in the future.

Natasha Amott, Owner of Whisk NYC said, “I furloughed six people. I am very concerned because in, so I opened up this location of whisk in 2018. My rating at that time I think was 3.625 percent, then in 2019, I had one fulltime staff person that I was forced to let go, and he went on UI. My first quarter payment, which I had to pay two weeks ago amidst all of this. There was no, I was not allowed to delay this payment. I would face penalties. So I had to make the payment of over $4,000, which for a small business shop, barely open, is very meaningful. That was the amount I paid because one person had been on UI, so just from my experience rating of 3.6. It was a huge amount of money so to think about six people now being furloughed, it stands to reason it could be well over $10,000 a quarter.”

Jeff Knauss, Co-Founder, Digital Hyve said, “I have not even thought about that to be honest and that I think is the point. The point here is there are so many pit falls to this whole thing, we are losing revenue like incredible amounts of revenue by the day, we are having to furlough our staff, we are having to make drastic decision that no business owner wants to make and on top of that we have additional concerns. It’s like plugging the dam every day, you know of pitfalls and things we have to keep in mind. I will say that it’s just another thing that this has really created. If we can make this easier and more simpler for people to understand and if we could have more forgiveness, and if there is not forgiveness, 8 weeks is a certainly a tight time frame, so we can go back to operating our business and taking care of our people.”

The National Federation of Independent Business, New York’s leading small business advocacy association, representing nearly 11,000 small, independent businesses across New York State is backing the bill. According to their memo of support, “Small businesses will lead New York’s recovery from this economic crisis, as long as they are not penalized with higher UI rates in future years..."

"Many of these businesses plan on rehiring laid off employees and should not be penalized as they start to reopen and rebuild," said Carlucci. "A large spike in unemployment insurance rates on small businesses will severely hinder their ability to grow."

According to the National Federation of Independent Business, New York’s more than 4 million businesses employ half of the state’s workforce and are responsible for half of its GDP.

related legislation

Share this Article or Press Release

Newsroom

Go to Newsroom

Senator David Carlucci Weighs in on New Toll Payer Advocate Offices

December 23, 2019

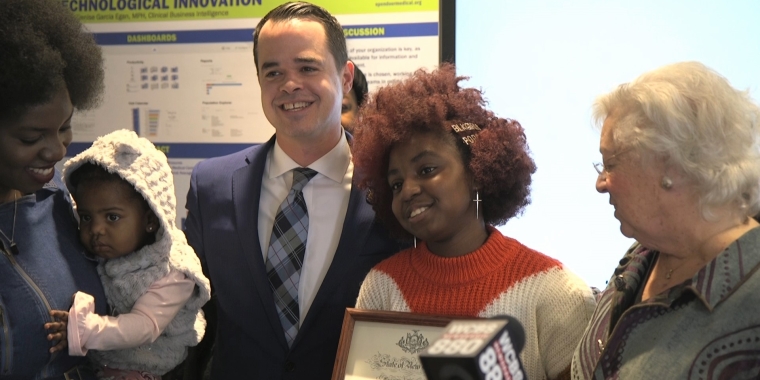

Lawmakers Present Mother & Daughter With the Signed Bill They Inspired

December 21, 2019