Senate Republican Conference Unveils Plan To “Reset Restaurant and Hospitality Industry”

January 26, 2021

-

ISSUE:

- Coronavirus Pandemic; COVID-19; Small Business

- Long Island Economy

- Job Creation

- Restaurant & Hospitality

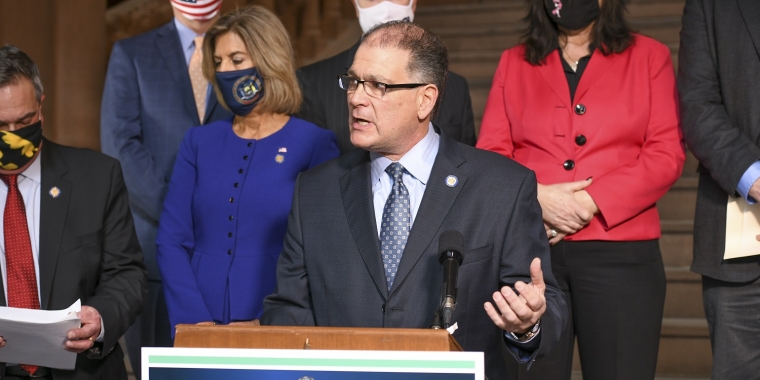

Senator Mario Mattera (2nd Senate District) joined with Senator George Borrello and other members of the Senate Republican Conference today to unveil a package of legislation to help “Reset New York’s Restaurant and Hospitality Industry.”

“Our restaurants and hospitality businesses are vital to our state’s economy and many of them are struggling just to keep their doors open and their workers employed. Like so many of our small businesses, these industries continue to be severely impacted by the ongoing crisis and New York State must step up immediately to help them survive so our entire economy can recover and grow stronger. This package will do just that and I am proud to join my colleagues in this effort to protect these businesses and all their employees,” said Senator Mattera.

The COVID-19 pandemic has presented unique challenges for all New Yorkers and crippled our economy - in particular our restaurants and hospitality businesses in New York State. Hundreds of thousands of New Yorkers work in this industry, including many hourly and tipped wage employees, and wait staff, bartenders, and hotel workers have counted heavily toward the state’s skyrocketing unemployment numbers since the onset of the pandemic last year. State coffers have also suffered, as the hospitality industry is the number one source of sales tax revenue in New York City, and number two in the state.

The cornerstone of the package of legislation advanced by the Senate Republicans today includes a comprehensive bill to provide relief to business owners and employers affected by the COVID-19 pandemic. The bill would:

- Exempt small businesses from being penalized with higher unemployment insurance rates due to layoffs resulting from COVID-related, government-mandated closures. The exemption would extend for a period of one year from when they are permitted to return to full capacity;

- Prohibit internet-based food delivery services from charging higher fees than they charged on or before March 1, 2020;

- Provide small businesses additional time to pay monthly sales and payroll taxes, as well as, business and property taxes;

- Offer interest-free loans or lines of credit to small businesses;

- Provide a one year extension for renewal of liquor licenses; and

- Provide businesses a 90 day grace period to pay any fees or penalties due to state and local agencies.

Also included in the plan announced by the Senate Republican Conference were pieces of legislation that would:

- Direct SLA-inflicted fines into a business relief fund to help small businesses get back on their feet (Senator Mike Martucci);

- Provide for a credit on liquor license renewals for the amount of time bars and restaurants were forced to be shut down due to the COVID-19 pandemic (Senator Joseph Griffo);

- Create a limited state sales tax exemption for the sale of food and drink at restaurants and taverns from state sales and compensating use taxes and granting municipalities the option to grant such limited exemption (Senator Daphne Jordan);

- Provide a tax check off box that will direct funds into a business relief fund (Senator Mario Mattera); and

- Create an employee retention tax credit, modeled after the Federal Employee Retention Credit, to help employers keep workers on payroll (Senator Peter Oberacker).

“This package of legislation includes necessary measures to help our restaurants and hospitality industry get back on their feet after the sharp declines in revenue they’ve suffered as a result of the pandemic and bad policy. Without assistance, too many of our small businesses are going to be forced to close their doors for good – the state needs to act quickly to provide relief,” said Senator Borrello.

Share this Article or Press Release

Newsroom

Go to NewsroomSenator Mattera Sworn In For 2nd Term In New York State Senate

January 11, 2023

Senator Mattera Celebrates New Eagle Scouts

January 10, 2023