Helpful Holiday Safety and Shopping Tips

Mario R. Mattera

November 20, 2023

To help make this year’s holiday season safe and enjoyable for all, my office organized this holiday safety section to help you protect your family, your home and your identity during this busy time of the year.

The information below is designed to make it easier for you to have a pleasant holiday season. From tips to protect you when you shop to links with information regarding home safety and toy recalls, this section is designed to put all the information you need in one convenient location.

I hope you will feel free to contact my office at 631-361-2154 or e-mail me at mattera@nysenate.gov if you have any questions or comments about this section or any state issue of importance to you and your family.

And please have a great holiday season and a very Happy New Year!

Mario R. Mattera

******************************************************

Protecting The Children In Your Life

Toy Safety Information from the United States Consumer Protection Safety Commission

Toy Safety Information From safekids.org

For a full up to date list of all recalls please visit THE UNITED STATES CONSUMER SAFETY COMMISSION RECALL WEBSITE

Currently, there are over 4,000 recalls and this website lists them in a number of categories:

*Recent recalls

*By Month and Year

*By product company and description

*By product category, including Child products, Toys, Household products, Outdoor products, Sports and Recreation products and Specialty products

PLEASE CLICK HERE TO REPORT AN UNSAFE TOY TO THE UNITED STATES CONSUMER SAFETY COMMISSION - If you are aware of a toy that may be unsafe, please visit the USCSC to report the toy so that other parents are aware of any unknown dangers

THE FOLLOWING SITES MAY ALSO BE OF USE:

WWW.RECALLS.GOV for additional information on other recalls - This website is maintained by the United States Consumer Safety Commission

*****************************

Protecting Your Family and Your Home During The Holiday Season

The New York State Office of Fire Prevention and Control (NYSOFPC)

Holiday Safety from New York State Division of Homeland Security and Emergency Services

Holiday Safety Information from National Fire Protection Association

Holiday Safety Tips from the American Red Cross

Suffolk County Fire Rescue and Emergency Management

United States Fire Administration - FEMA

Tips To Keep Your Home Safe If You Travel

Holiday Pet Safety Information from the ASPCA

SUFFOLK COUNTY POLICE DEPARTMENT INFORMATION

1st Precinct 555 Route 109, West Babylon - 854-8100

2nd Precinct 1071 Park Ave, Huntington - 854-8200

3rd Precinct 1630 5th Ave, Bay Shore - 854-8300

4th Precinct 345 Old Willets Path, Hauppauge - 854-8400

5th Precinct 125 Waverly Ave, Patchogue - 854-8500

6th Precinct Route 25 / Middle Country Rd, Coram - 854-8600

7th Precinct 1419 William Floyd Parkway, Shirley - 852-8700

Town of Smithtown Department of Public Safety - 631-360-7553

Town of Brookhaven Department of Public Safety - 631-451-6291

Town of Huntington Public Safety - 631-351-3167

*********************************

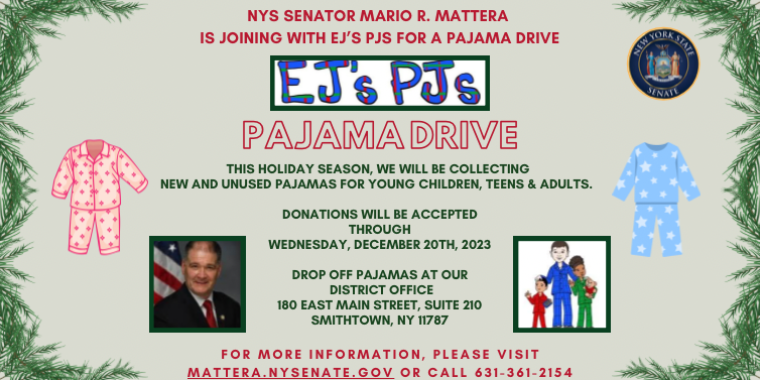

HELPING LONG ISLANDERS IN NEED

Below are links that will allow you help those who work so hard to provide for our friends and neighbors:

SALVATION ARMY of Greater New York

Smithtown Emergency Food Pantry - 631-265-7676

90 Edgewater Avenue, Smithtown

INFORMATION ON GIVING

Charitable Giving Tips from New York State

New York State Charities Bureau Registry Search – look up a charity before you give

For a full listing of NATIONAL ORGANIZATIONS, PLEASE CLICK HERE for reports from the Better Business Bureau

The BBB WISE GIVING ALLIANCE offers guidance to donors on making informed giving decisions

IF YOU HAVE AN ORGANIZATION THAT YOU WOULD LIKE FEATURED ON THIS PAGE, PLEASE SEND SENATOR MATTERA AN E-MAIL TO OUR OFFICE AT MATTERA@NYSENATE.GOV

*********************************

Tips For Safe Holiday Shopping

The New York State Consumer Affairs is warning consumers to use caution as they look for bargains in stores and online when they are doing their holiday shopping this year.

The following links will access information from the New York State Consumer Affairs:

NYS Consumer Affairs Guide To Holiday Shopping

Refunds, Rebate and Rainchecks

Toy Safety Information from the United States Consumer Protection Safety Commission

Online Shopping from Safe Online Organization

***************************************

Helpful Holiday Shopping Tips from Travelers

Parking Lot Safety Tips From AAA

*****************************************

ONLINE SHOPPING SAFETY

Click here for Safe Online Shopping Tips from the New York State Attorney General's Office

Remember To:

• Compare product prices.

• Check website privacy policies.

• Note shipping and handling fees.

• Review warranties.

• Check the company’s refund policies.

• Keep records and retain a copy of your purchase order and confirmation number from the website. Companies may also send you important e-mails regarding your purchase. You should retain these documents until you have resolved any concerns regarding your online purchase

Online shopping is convenient and presents us with more choices and better deals than we can find locally. However, inherent dangers in shopping online include fraud, identity theft and privacy invasion.

Therefore, consumers should exercise caution and consider these tips:

• Only buy from a trustworthy and reputable seller. If a website looks unprofessional, don’t buy from it.

• Request a catalogue or brochure from a company you are unfamiliar with before you shop from its website.

• Understand the product you are buying and the terms of the sale. Double-check price and quantity, and comparison-shop on other websites. If a deal seems too good to be true, it probably is.

• Before buying online, research promotional codes (online discounts) offered by retailers which can provide significant savings on your purchases. Many times you can secure free shipping or save as much as 30 percent off your total purchase.

• Designate one credit card for online shopping, as this will allow for an easy review of purchases and provide protection in case of a dispute. Don’t use a debit card.

• Assure that your credit card information stays safe by checking that the website uses encryption. Before entering credit card information, make sure that the website’s address begins with “https” and that there is a closed lock or unbroken key symbol in the lower portion of your window.

• Provide your credit card number each time you make a purchase. Don’t agree to the seller keeping it on file for future purchases.

• Read and understand the site’s privacy policy and practices, as online shopping means that the seller will be collecting your personal information. Make sure you know how the seller intends to use and possibly retain your information.

• Print out order forms, order numbers, purchase confirmation and policies – keep a record of your transaction.

• Make sure you keep your computer’s operating system up-to-date by regularly downloading the latest security patches. Use other security precautions, such as anti-virus and anti-spyware programs, and install a firewall.

Protect Yourself with STOP. THINK. CONNECT from Homeland Security

Additional Resources:

OnGuardOnline.gov: Shopping Online

OnGuardOnline.gov: Online Shopping Infographic

U.S. CERT: Shopping Safely Online

Information on Gift Cards from New York State Comptroller's Office

*****************************************

Protecting Yourself From Identity Theft

While the holiday season is a great time for families, it can also be a great time for identity thieves. It’s not just pick-pockets who steal your credit cards and money anymore. Advances in computer technology have made it possible for ID thieves to ruin your credit and tarnish your good name. Below are tips to protect you and your family.

Identity Theft Tips From USA.GOV

Identity Theft Information from the Federal Trade Commission

Tips for Smart Shopping

*Keep records. Print a copy of your purchase order and confirmation number from the web site. Companies also may send you important emails regarding your purchase. You should retain those emails until you have resolved any concerns regarding your online purchase.

*Check shipping and handling fees.

*Compare prices.

*Review warranties.

*Check the company’s refund and shipping policies.

To file a complaint if you have a problem with a retailer, please click here to visit the Office of the New York State Attorney General.

The New York State Division of Consumer Protection offers a wide range of services for consumers. If you feel that a retailer has violated your consumer rights, contact the Division of Consumer Protection for Information, Advice and to file a complaint.

Suffolk County Residents can also contact the Suffolk County Office of Consumer Affairs at 631-853-4600

The Better Business Bureau (BBB) system in the U.S. extends across the nation; coast-to-coast, and in Hawaii, Alaska, and Puerto Rico. Since the founding of the first BBB in 1912, the BBB system has proven that the majority of marketplace problems can be solved fairly through the use of voluntary self-regulation and consumer education. The BBB core services include Business Liability Reports, Dispute Resolution, Truth-In-Advertising, Consumer and Business Education, and Charity Review.

Click here to access the Better Business Bureau

DOs

DO guard your computer password and use only secure lines to transmit financial information via the Internet. Look for an unbroken key or lock in the corner of your computer screen to signify a secure connection.

DO ask why a merchant needs private information, how it will be used and secured, and whether it will be shared with others. Ask if you can choose to have it kept confidential.

DO know the privacy policies of businesses with which you deal and websites that you visit.

DO register for NYS’s “Do Not Call” Registry to reduce the possibility of telemarketing fraud.

DO talk about privacy concerns with your children. Everyone should understand the importance of protecting personal information.

DO ask about information security procedures in your workplace. Find out who has access to your personal information and verify that records are kept in a secure location. Ask about the disposal procedures for those records as well.

DO guard your mail and trash from theft. Promptly remove mail from your mailbox and deposit outgoing mail in official post office boxes. Tear or shred documents that contain personal information before depositing in the trash.

DON’Ts

DON’T give credit card, debit card or bank account information over the Internet or phone, unless you’ve initiated the contact and/or you are dealing with an established business that you know.

DON’T give your Social Security number (SSN) to anyone, except your employer, government agencies, lenders and credit bureaus. It’s all a privacy pirate needs to steal your identity; also, don’t carry your SSN card.

DON’T provide personal information to merchants or sales clerks that isn’t required.

DON’T reply to “spam,” which is unwanted e-mail messages that clutter up your computer in-box and slow your connection to the Internet. That tells a spammer that your e-mail address is active. Instead, notify your Internet provider of the offender.

DON’T use obvious, easy-to-guess passwords on your credit card, bank and phone accounts. Avoid using your mother’s maiden name, your birth date or the last four digits of your SSN.

SECURITY FREEZE LAW

NYS law gives residents another weapon in the fight against identity theft by allowing you to place a security freeze on your credit files. A security freeze prevents your credit information from being released without your consent.

With a “freeze,” outside parties would be unable to view your credit files without your approval. Since banks and credit agencies usually do not issue new loans, credit, or mortgages without first viewing the applicant’s credit history, the security freeze prevents an identity thief from using your name to obtain these services, even if they have your Social Security number.

There is no charge for placement of the first Security Freeze. You can be charged up to $5 to place a second or subsequent freeze on your report or to remove the Security Freeze.

If you are a victim of identity theft, there is no charge for placement, removal or restoration of a Security Freeze as long as you provide a copy of an identity theft report from a law enforcement agency or an ID Theft Victim Affi davit from the Federal Trade Commission. Placing and temporarily lifting a Security Freeze is also free for victims of domestic violence. To be eligible, victims must provide an order of protection, a domestic violence incident report, a police report, or a signed affi davit from a service provider.

To place a security freeze on your credit files, you must send a certified or overnight letter with your name, address, Social Security number, and date of birth to each of the three major credit bureaus at the addresses listed below.

• Equifax Security Freeze, PO Box 105788,

Atlanta, Georgia, 30348 - 1-800-349-9960

• Experian Security Freeze, PO Box 9554,

Allen, Texas, 75013 - 1-866-580-6066

• Trans Union Security Freeze, PO Box 6790,

Fullerton, California, 92834-6790 - 1-888-909-8872

REVIEW YOUR CREDIT REPORT

You are entitled to receive a free copy of your credit report once every 12 months from each of the three nationwide consumer credit reporting companies (listed below). Consumers sometimes find out that they’re victims of identity theft when they try to make a major purchase and discover unfavorable information in their credit reports.

Legitimate loans can be denied or delayed while the credit mess is straightened out. Knowing what’s in your credit report allows you to fix problems before they jeopardize a major financial transaction.

Credit Bureaus

Equifax (http://www.equifax.com/home/en_us)

Experian (http://www.experian.com/assistance/free-annual-credit-report.html)

TransUnion (http://www.transunion.com/)

IF YOU BECOME A VICTIM OF IDENTITY THEFT

If you become a victim, call 1-877-ID-THEFT to get a copy of the Federal Trade Commission’s ID Theft Affidavit form. This affidavit will help you report information to many companies using just one standard form, simplifying the process.

It is also important to report the fraud to the following organizations:

1. Each of the three national credit bureaus (listed at left). Ask each agency to place a “fraud alert” on your credit report, and send you a copy of your credit file.

2. The fraud department at each creditor, bank, or utility/service that provided the identity thief with unauthorized credit, goods or services.

3. Your local police department. Ask the officer to take a report and give you a copy of the report. Sending a copy of your police report to financial institutions can speed up the process of absolving you of wrongful debts or removing inaccurate information from your credit reports. If you can’t get a copy, at least get the number of the report.

4. The Federal Trade Commission, which maintains the Identity Theft Data Clearinghouse and provides information to identity theft victims. You can visit www.ftc.gov/idtheft.

*********************************