Senate Passes $3.3 Billion Tax Cut and Job Creation Plan

Owen H. Johnson

December 8, 2011

Posted by Majority Press on Wednesday, December 7th, 2011

On December 7, the state legislature passed the Governor's Middle Class Tax Cut and Job Creation legislation that reduces the MTA payroll tax on small businesses while maintaining the necessary funding for the MTA from other sources. The tax will be eliminated for 289,000 small businesses, defined as those having an annual payroll between $10,000 and $1.25 million, in the MTA region. Additionally, more than 6,000 businesses with payrolls between $1.25 and $1.75 million will see their payroll tax cut by either one third or two-thirds. The MTA payroll tax cut will also benefit approximately 414,000 self-employed taxpayers. All elementary and secondary schools, public or private, are exempt from the payroll tax under the new law. The new law has no impact on MTA funding as the state will compensate the MTA for all revenue lost by the tax cut.

The bill (S.50001, S.50002) cuts taxes paid by manufacturing companies; encourages job retention; invests in infrastructure improvements; addresses flood relief and recovery; eliminates tax indexing; and sets aside additional money in state reserve funds.

“The Senate has worked in bipartisan fashion with the Governor and the Assembly to show that state government can function in the best interests of taxpayers,” Senate Majority Leader Dean G. Skelos said. “In the past year we've accomplished some very important things, including eliminating a $10 billion deficit, bringing spending under control and capping property taxes. Today we are taking another huge step forward by cutting taxes for millions of individuals and businesses and providing new investments and incentives to help businesses create private sector jobs.”

The Middle Class Tax Cut and Job Creation Plan is supported by major business organizations across the state including: The Business Council of New York State; Unshackle Upstate; the Long Island Association; the National Federation of Independent Businesses; the Partnership for New York City; and the New York Farm Bureau.

“The turnaround in this state has been dramatic,” Senator Skelos said. “Just two years ago, when Democrats controlled the Senate, both spending and taxes were increased by $14 billion, businesses and jobs were driven away and Albany was beset by gridlock and dysfunction, just as we are seeing in Washington, D.C. The progress Senate Republicans have made, working with Governor Cuomo, to reduce state spending and taxes will benefit taxpayers and help strengthen our economy.”

Highlights of the Middle Class Tax Cut and Job Creation bill include:

MIDDLE CLASS TAX CUT

Approximately 4.4 million middle-class taxpayers will receive $690 million in personal income tax relief, allowing them to save, spend and invest more of their hard-earned money. After these tax reforms are implemented, middle-class taxpayers will pay the lowest tax rate in more than 50 years.

MTA PAYROLL TAX REPEAL

This plan repeals the devastating MTA payroll tax for about 78 percent, or more than 704,000, of the business entities that currently pay it. This includes eliminating the tax for 290,000 employers with payrolls of less than $1.25 million; 415,000 self-employed taxpayers; and all public and non-public schools.

TAX CUT FOR MANUFACTURERS

The corporate tax rate on manufacturers outside of the MTA region will be cut in half, providing $25 million in tax savings, a major boost for job creation. Senate Republicans have long championed lower taxes for New York’s manufacturers as a way to create jobs.

ELIMINATE TAX INDEXING

Under the provisions of this bill, income brackets and the standard deduction will be adjusted for the rate of inflation, eliminating “bracket creep,” and providing about $440 million in tax savings over two years for every New Yorker that pays the personal income tax.

PERSONAL INCOME TAX SURCHARGE ELIMINATION

The bill eliminates the PIT surcharge, enacted by Democrats in 2009. Ninety-one percent of taxpayers currently impacted by the surcharge will receive a tax cut. Rates would revert back to the lower rate they paid prior to the enactment of the surcharge.

FLOOD RELIEF

$50 million in additional relief will be provided for areas affected by the recent flooding. A job retention tax credit will also be extended to businesses harmed by a natural disaster within the last year.

CAPITAL INVESTMENTS AND JOB CREATION

A new $1 billion infrastructure fund has been established to rebuild roads, bridges and other infrastructure, and encourage the creation of thousands of related jobs. These investments are expected to leverage $10 billion in capital investments. Projects immediately expedited through the infrastructure fund total $2.6 billion.

Specific investments by the infrastructure fund include replacing bridges, rehabilitating dams and flood control infrastructure, rebuilding water systems, renovating parks and projects that support regional economic development plans.

INNER-CITY YOUTH EMPLOYMENT

The bill includes $37 million in funds for job readiness training for inner-city youth and provides $25 million in tax credits for employers who hire unemployed youth.

SETTING ASIDE MORE MONEY IN RESERVES

The plan sets aside $1.5 billion, completely unspent and held in reserve for economic uncertainties and to help support: job creation; local government mandate relief; ensure funding for education and health care; and closure of budget gaps.

Share this Article or Press Release

Newsroom

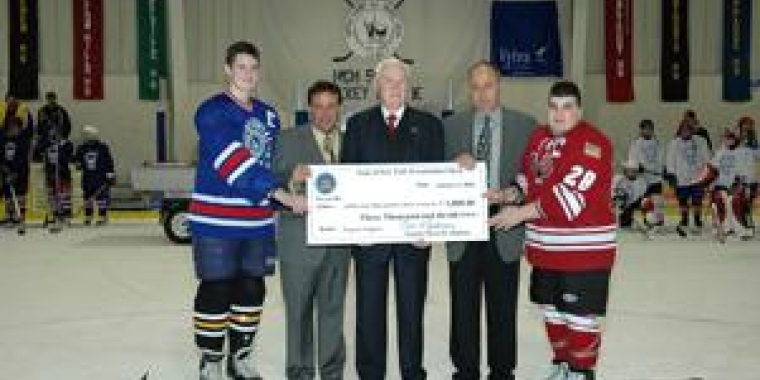

Go to NewsroomSenator Johnson Secures Funds For B.c. Help

February 2, 2006

Johnson And Sweeney Secure $200,000 To Fight Gangs

January 26, 2006